Little Savers

Empowering Little Savers to become Big Investors

What is Little Savers?

How It Works

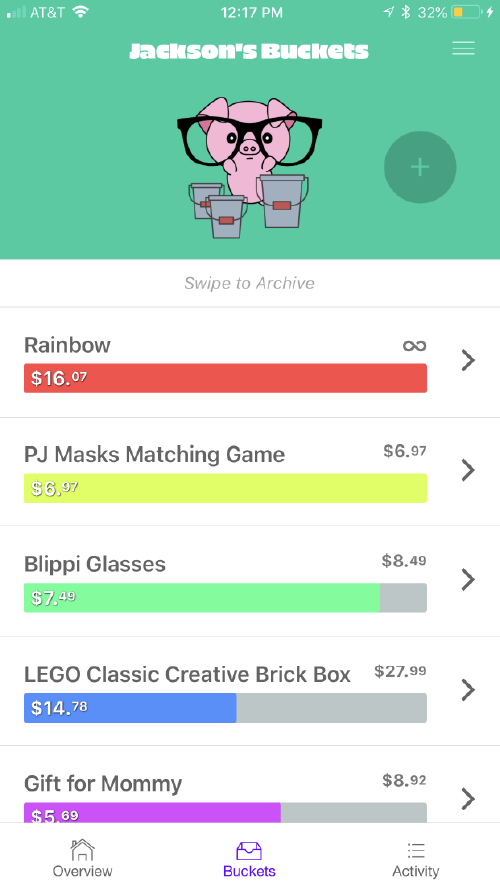

Add a savings bucket for each thing your little one must have. Think of these like savings goals; They could be for a certain toy, a gift they'd like to give, or just saving for a rainy day.

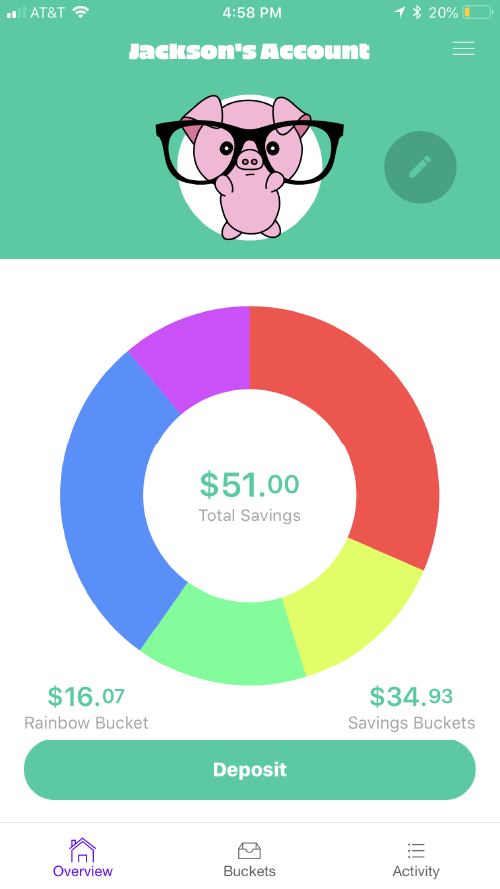

How much now?

Your Little Savers will have fun checking on their account and feel a sense of accomplishment as their savings grow.

With each deposit, a portion is diverted to their savings bucket — this is for long-term savings and investment; their dream bucket. The rest is split amongst their savings buckets.

Learning to automatically put a portion of their savings aside is a habit that will pay dividends well into adulthood.

Can I get this, pleeease?

Whenever your Little Saver wants to buy that shiny new toy, simply consult their Little Savers account to see if they've saved enough to make the purchase.

Learning about the relationship between earning, saving and getting the things they want is an invaluable lesson that can't start soon enough.

Before long they will be coming to you looking for ways to earn more money to fill up their savings buckets.

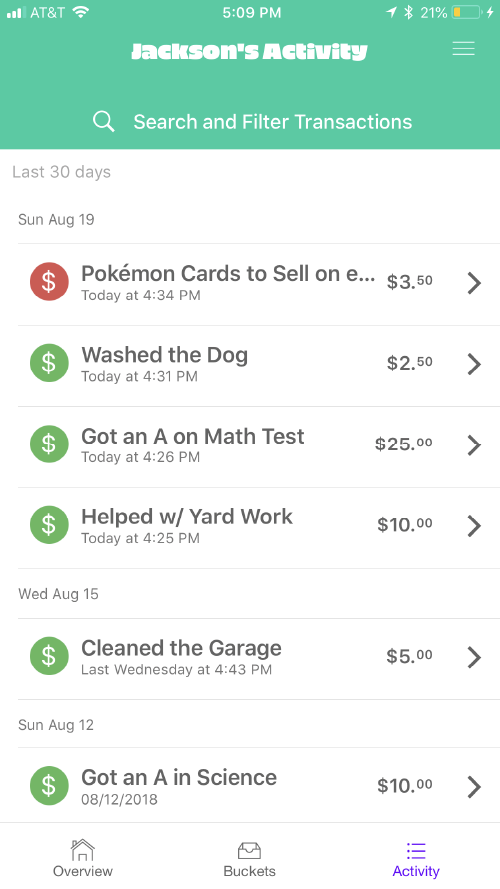

But I thought I had...

Little Savers can be reminded of how their money was earned (or spent in case they forget).

They'll learn that financial resources are limited and that the money they spent on Roblox yesterday won't buy a new Barbie today — unless of course, they continue to earn.

Doing chores and getting good grades in school are great ways to earn. Deposit birthday and holiday gifts as well.

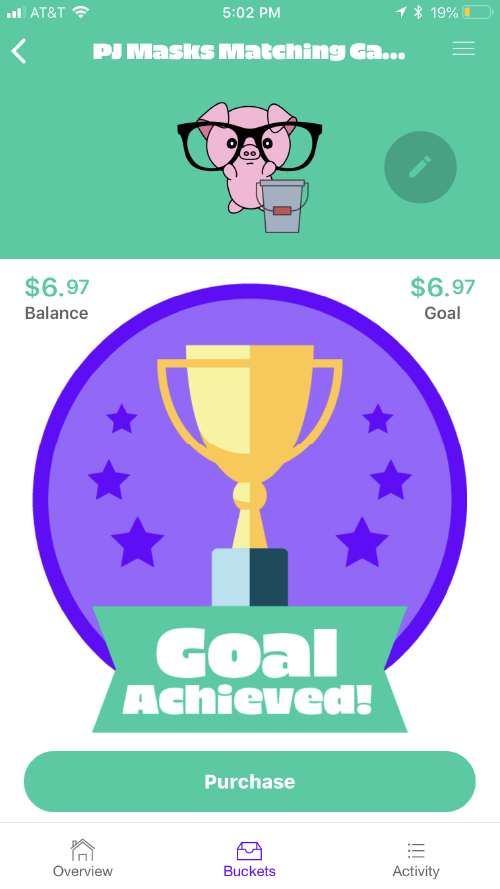

Success!

Once a bucket is full, your Little Saver gets what they've saved for in that bucket.

Little Savers learn to defer gratification until they've saved enough to make a purchase. Deferred gratification is thought to be a key indicator of success, both financial and otherwise.

Mission

Our Motivation

As parents, we have the natural inclination to provide our kids with the things, or the kind of life, that we wished we had growing up. This, however, can be a perilous pursuit if our little ones don't understand the relationship between hard work, money, and the stuff they want... and be an early adopter (and adapter) to the modern age of digital currency.

Little Savers helps to bridge that gap and provides a real understanding of how to get the things they want.

The idea is to help kids become Little Savers and earn their financial wings!

Our Story

Little Savers grew out of the desire to help our own kids learn, from a young age, about the relationship between earning, saving, and spending -- and to give them the things they want without producing yet another spoiled kid.

When our daughter was about five, we began introducing her to the concept of "save half, spend half" -- where any time she'd earn money, get a birthday gift, or find change in the couch, we'd put half away for a rainy day, and take the other half and save it for things she'd like to buy. We initially kept track of this in a spreadsheet, but with a little bit of help from her we fleshed out the idea and the Little Savers dapp was born.

Success Story

Even at such a young age, our daughter is fully accustomed to diverting a portion of her earnings toward long-term savings and investment and socking away the rest in her savings buckets for things she'd like to buy.

So any time she wants something (and desire for little ones is not only endless but a moving target), she knows that we need to consult her Little Savers account first to see where she stands financially.

The Little Savers dapp makes an interesting centerpiece around which these conversations can be had, all while instilling solid financial habits and fostering the invaluable mindset of deferred gratification.